April is Fair Housing Month

April is Fair Housing Month. Today, I am taking you on a historic tour of my day-job industry, and it isn’t pretty. The hopeful signs are that the National Association of Realtors® has recognized its complicity in discrimination and made efforts to change. But housing discrimination is a major factor in economic inequality in America.

Take a look at the map in this article from 2018. Notice where a year-long analysis of 31 million lending applications found a pattern of discrimination against Blacks and Latinos.

Does this map match your intuition about racial discrimination in America?

The people who stand behind the study say that it used academically approved methodology, with a large sample. It was independently reviewed and confirmed by the Associated Press.

“It’s not acceptable from the standpoint of what we want as a nation: to make sure that everyone shares in economic prosperity,” said Thomas Curry, who served as America’s top bank regulator, the comptroller of the currency, from 2012 until he stepped down in May.

However, since May 2017, monitoring of lending practices has decreased, due to changes made by the previous administration. At the same time, they stated that they remained committed to fair mortgage lending practices for all people, regardless of race.

“While quite informative regarding the state of the lending market,” the records analyzed by Reveal do “not include sufficient data to make a determination regarding fair lending,” the Mortgage Bankers Association’s chief economist, Mike Fratantoni, said in a statement.

Fair Housing is where my professional life and my political life intersect. Home ownership, if done responsibly, is America’s way to jump from the working class into the middle class.

Reversing the trend

When the Biden Administration took office in January, 2021, they made promising personnel changes in the Federal agencies that oversee lending. Skadden.com explained the changes ahead. The post concluded by advising lenders to prepare for Federal agencies to be paying attention to fair lending rules. They wrote:

“Given the likelihood of increased fair lending enforcement in the Biden administration, financial services institutions should review their fair lending policies and procedures to ensure compliance with applicable laws and regulations, and carefully monitor areas of focus by regulators and enforcement agencies.”

It is clear that the lending industry cares about being caught violating fair housing rules. But, do they care about fair housing or fair lending?

A very quick history of Fair Housing:

After World War II, the United States government created The Servicemembers’ Readjustment Act of 1944, an economic stimulus package commonly called “The G.I. Bill.” This boosted housing development by offering mortgage incentives to veterans.

There were also educational benefits, which made college possible and vocational training for people who served in the military during the war. By 1956, roughly 7.8 million veterans had used the G.I. Bill education benefits, some 2.2 million to attend colleges or universities and an additional 5.6 million for some kind of training program.

The G.I. Bill is often credited for the prosperity of the 1950s and 1960s. But that prosperity was biased toward white veterans.

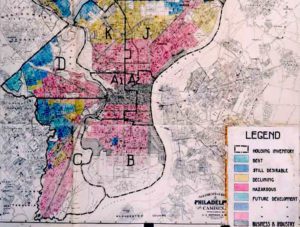

In these years, Jim Crow segregation laws were still in effect. Redlining was common. (Redlining is a pattern of lenders rejecting mortgages for properties in specific “declining”

In these years, Jim Crow segregation laws were still in effect. Redlining was common. (Redlining is a pattern of lenders rejecting mortgages for properties in specific “declining”

or “hazardous” neighborhoods. Named for the practice of drawing a red line or coloring the areas red, mostly minority, “hazardous” neighborhoods.)

The effect of redlining was that many African Americans could not benefit from no-down-payment, low rate G.I. mortgages in neighborhoods where other African Americans lived. In many parts of the country, African American could only live in African American neighborhoods, due to segregation and social patterns of racism. G.I. starter homes, like the 17,000+ Levittown houses across America, were restricted to Whites only. So were many other, less well-known housing developments.

The G.I. Bill made it possible for white veterans to buy houses. Racial housing discrimination restricted many Black veterans from doing so. Of the first 67,000 mortgages insured by the G.I. Bill, fewer than 100 were taken out by non-whites. *

White veterans who bought starter homes in the 1950s had a foothold into housing appreciation. The cost of housing is typically 25-33 percent of household income. Housing appreciation is an exceptionally good way to build assets. It turns the cost of housing into a commodity that can be resold at a profit, most of the time. Renters pay for housing and do not gain assets.

Fast-forward two generations or so.

Fast-forward two generations or so.

The latest figures from the U.S. Census Bureau show the median net worth for an African American family is $9,000, compared with $132,000 for a white family. Latino families did not fare much better at $12,000.

Fair housing is essential to economic justice in America. April is Fair Housing Month.