How to think about “the economy”

If the economy is doing better, why are Americans feeling less secure? That was the question in 2010, and it is a question now.

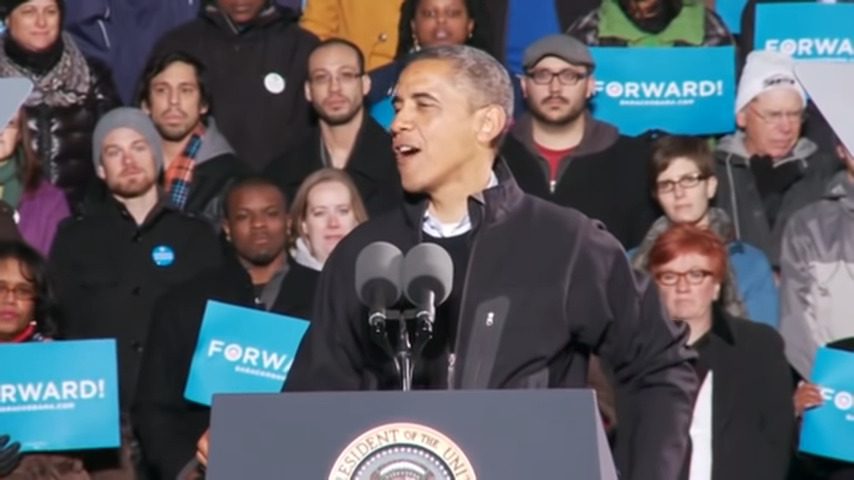

I am currently reading A Promised Land, the political memoir of Barack Obama. I just got to the “car in a ditch speech” meme he used running up to the 2010 midterm election.

Obama’s analogy was that the Republican President left office with the economy like a car in a ditch. Democrats have been pushing the car out of the ditch. Now (2010), it is out of the ditch. It is muddy and a little dented. But it is ready to roll again. He implores American not to give the Republicans the keys back, “they don’t know how to drive!”

Why wasn’t the speech convincing?

In 2010, there was ample evidence to the eyes, ears, and wallets of Americans that the economy was not yet rolling. Yes, there were significant signs that the recession was passing. Yet day-to-day economic life was nowhere near back to normal. People who were out of work and people who fell behind on their mortgages were not faring well. Many Americans were still in dire straits, or knew someone in dire straits.

The point that the economy was out of the ditch was not proven, in a personal way. Those that were not already intending to vote Democratic would not be convinced by the metaphor.

Economics is complicated. However, the nuts-and-bolts information could have helped in the messaging in 2010. It needed to be said that jobs and spending were returning as unemployment went down. A picture of the expectations for recovery was needed for those still struggling in the fall of 2010.

Obama is good with a story. He should have told more of them. There were stories of people who had gotten their own cars back on the road through stimulus that the Obama administration had passed.

Americans vote “the economy,” but what is that?

Think of those buzz-words you hear:

Consumer confidence: good news is when consumers are spending money. This is measured by big-ticket items like houses and cars, but also general consumer purchases.

Gross domestic product (GDP): good news is when the country is making things and selling services.

Unemployment rate: good news is when it is low.

Stock and Bond indices: good news is when they are going up.

There are general patterns that occur based on how many products and services are created and how many people are employed in that making. Then, are they being sold? When people are unemployed — or concerned about being unemployed — they spend less. When people buy less, the people who produce products and services lose their jobs. Or vice versa, when people aren’t creating products or doing services, there are not enough of some products and services. Those products become rare and more valuable; then we have inflation.

The economy in 2021:

Fast-forward to the first year of the Biden Administration. The economy was in a different ditch when he took office. This one was caused by a global pandemic. In 2020, most non-essential business ground to a halt. This happened unevenly.

- People in well-paid tech positions were in a better situation to move their work to at-home, via Zoom or other video platform for meeting. Those people were not economically harmed.

- Face-to-face service workers were either unemployed or were working at risk of catching the virus. They were harmed and may fear more harm.

- Some product manufacturing stopped entirely, some shifted to different products, and essential items continued or increased production.

- Schools were closed from March to May or June in 2020. Parents (particularly mothers) juggled childcare and their full-time jobs at home. Many women left the work force. Their family economies were harmed.

- There was a labor shortage, starting in the summer of 2020. A large part of it is in face-to-face jobs that do not pay well. Those jobs are dangerous during a pandemic. Many people left food service, hospitality, and retail jobs. In 2021, people are re-employed, but not in the same industries. The labor shortage in food service and hospitality continue. Those businesses were harmed and are still being harmed.

The side effect of people being unemployed, or choosing to stop work for family or health reasons, is that people spent less until they regained confidence in their ongoing income. In 202, that slowed the economy. In 2021, unemployment went down dramatically; consumer confidence went up, and people were spending money again. Production of goods and service is coming back. When consumer confidence first picks up, the demand will cause inflation.

Think about those buzz-words! In the last quarter of 2021, this is the condition of the economy:

Consumer confidence: consumers are spending with confidence.

Gross domestic product (GDP): has recovered from 2020 slump and is still going up.

Unemployment rate: has gone down to normal levels.

Stock and Bond prices: is high and is mostly going up.

A good summary of recent economic news comes from Bankrate. This is a site aimed at the real estate industry, that’s why it advertises heavily for mortgage products.

Looking ahead to 2022:

The pandemic news is uncertain. Each new variant of the Covid-19 virus is causing stress on medical facilities. Bad news causes change in spending habits and work habits. Will people fly for vacation? Will they stay in hotels? Will they eat in restaurants? Are they confident enough to spend on big-ticket items like houses and cars? Can they find the items they want to buy? (there are house, car, and appliance shortages!)

Economic news is full of fears of inflation. It is not clear how much inflation will erode our spending power. This is a real concern, especially for families who are living without savings and had their saving eroded during 2020 and 2021.